特斯拉电池供应商松下因电动汽车需求减弱而撤回扩张计划

2024-06-09 09:41阅读:

松下正在修改其雄心勃勃的目标,并可能将其原定在北美的部分产能转移到日本市场 作者:

山姆·史密斯(Sam

D.Smith) ![特斯拉电池供应商松下因电动汽车需求减弱而撤回扩张计划]()

- 松下将取消其 2030 年目标,以实现 4 倍的产能和 3 倍的收入目标。

- 该公司表示,它仍然致力于实现目标,但达到目标的日期不再重要。

- 这家电池制造商可能会转移北美供应以满足日本的需求。

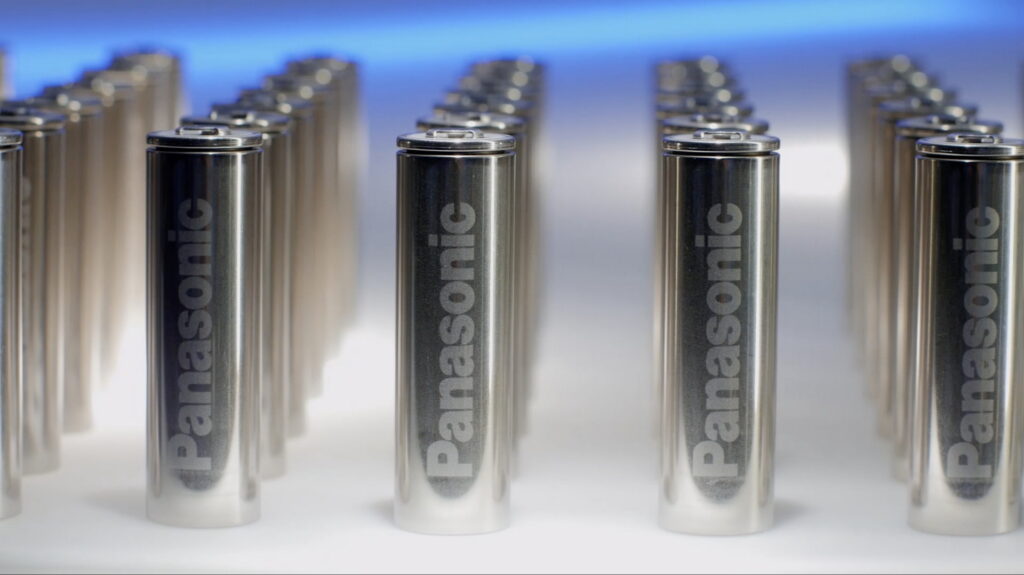

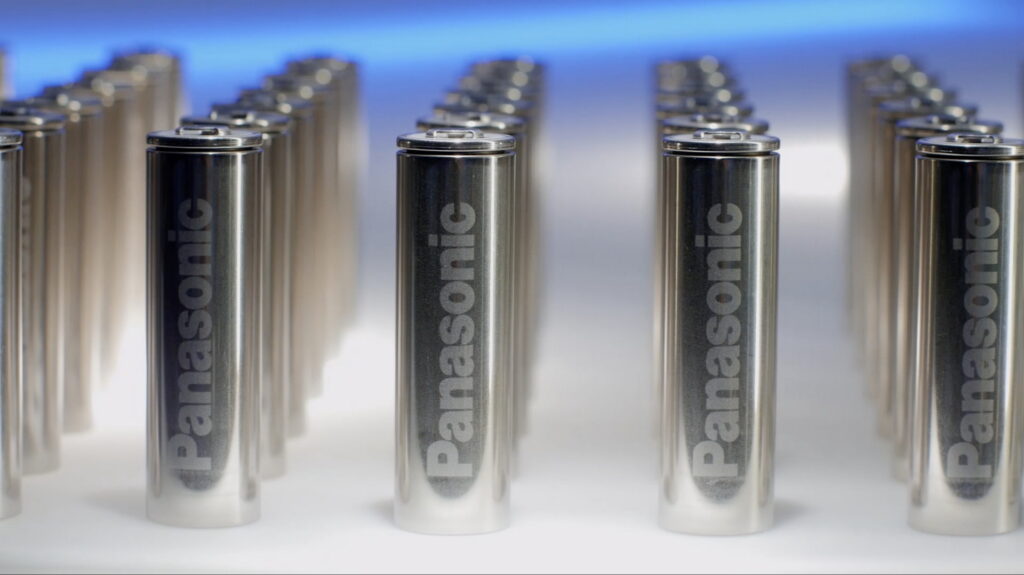

松下认为,在短时间内将电动汽车

电池产量翻两番的做法是不明智的。不到一年前,这家日本电池制造商宣布打算在2030财年末将全球生产和采购能力从50

GWh提高到200 GWh。

该公司为

包括特斯拉和

Lucid在内的多家汽车制造商提供电池,宣布将停止其雄心勃勃的扩张计划。虽然该公司表示仍将达到200GWh的产能目标,但该日期已从2030年移至待定。松下还下调了其目标,在同一时期将收入增加两倍。

相关阅读:3月美国电动汽车销量增长3.8%,特斯拉下降12%

该公司高管的重新评估是由北美电动汽车销售普遍放缓引发的。虽然在美国道路上注册的电动汽车数量创下历史新高,但增长已经开始放缓,多项研究仍然表

明,缺乏充电基础设施和高昂的购买成本困扰着有关买家的心。

“从目前的市场来看,我们决定,与其执着于(目标)数字,更重要的是以可观的利润和一定的市场份额为目标,”松下首席执行官Kazuo

Tadanobu说

。

松下与特斯拉合作投资了两家美国工厂,一家位于内华达州,另一家位于堪萨斯州。然而,它错过了原定于3月发布的公告。该计划是透露第三家北美工厂的细节。然而,Tadanobu告诉记者,他没有进一步的信息可以分享这方面的信息,但已经对这些信息进行了评估,以便在需要时做出“迅速决定”。

虽然北美BEV需求放缓,但松下看到了日本市场的潜力。该公司已经在与同胞斯巴鲁和

马自达就圆柱形锂离子电池的供应进行谈判。这家电池制造商可能会将其部分国内产能(原定用于北美客户)转而生产日本电动汽车的电池。

标签 电池

电动汽车

日本

LUCID

马自达报道

斯巴鲁

特斯拉美国

原文阅读

标签 电池

电动汽车

日本

LUCID

马自达报道

斯巴鲁

特斯拉美国

原文阅读

Tesla Battery Supplier Panasonic Walks Back Expansion

Plans Due To Waning EV Demand

Panasonic is revising its ambitious goals and may divert some of

its capacity originally slated for North America to the Japanese

market

by

Sam D.

Smith

June 7, 2024 at 15:00

- Panasonic will remove its 2030 target to achieve 4x

capacity and 3x revenue goals.

- The company says that it still aims to hit targets, but

a date to reach them is no longer important.

- The battery maker may divert North American supply to

fulfill Japanese demand.

Panasonic has decided its course of quadrupling EV

battery production in

a short space of time was ill-advised. Little under a year ago, the

Japanese battery manufacturer announced its intention to increase

global production and procurement capacity from 50 GWh to 200 GWh

by the end of the 2030 fiscal year.

The company, which supplies batteries to several automakers,

including

Tesla

and

Lucid,

announced that it will put the brakes on its ambitious expansion

plans. While it says it will still hit that 200 GWh capacity goal,

the date has moved from 2030 to TBD. Panasonic has also revised

down its aim to triple revenue in the same period.

Read:

U.S. EV Sales Up 3.8% And Tesla Down 12% In

March

The reassessment by the company’s executives has been triggered by

the prevalent slow-down seen across the sales of EVs in North

America. While a record number of EVs are being registered on

American roads, growth has begun to taper off, with multiple

studies still suggesting that a lack of charging infrastructure and

high purchase costs weigh on the minds of concerned buyers.

“Looking at the current market, we decided that rather than be

fixated on the [target] number, it’s more important to aim for a

decent profit and a certain amount of market share,” says Panasonic

CEO Kazuo Tadanobu, quoted by

Nikkei Asia.

Panasonic has invested in two U.S.-based factories in partnership

with Tesla, with one in Nevada and another under construction in

Kansas. However, it missed an announcement that was due to take

place in March. The plan was to reveal details on a third North

American plant. However, Tadanobu told reporters that he had no

further information to share on that front, but that information

had been evaluated to make a “speedy decision” if the need

arises.

While North American BEV demand slows, Panasonic sees potential in

the Japanese market. The company is already in talks with

compatriots Subaru and

Mazda over the supply of

cylindrical lithium-ion batteries. The battery maker may divert

some of its domestic production capacity, which had been earmarked

for North American customers, to instead make batteries for

Japanese EVs.

![特斯拉电池供应商松下因电动汽车需求减弱而撤回扩张计划]()